On the 18th of September this year, the US Federal Reserve System slashed its interest rates for the first time in four years. The Federal Reserve System, also known as the Fed, lowered its lending rate by fifty basis points (0.5%), bringing it to a range of 4.75%-5%. As the Fed is also dubbed the “orchestrator of the world’s largest economy”, this rate cut is of utmost importance.

When the Fed introduces changes in interest rates, it aims to target two main areas: inflation and employment. Many economists view this recent change in policy as a turning point, that signals the US Central Bank’s efforts to control the ‘inflation beast’ – which began to surge in 2021, fueled by the COVID-19 pandemic and the emergency policies it triggered. In fact, during the pandemic, inflation was at an all-time high of 9.1% in June of 2022. As a result, the prices people paid for goods and services rose by almost 9 percent in 2022 in the US and Europe. In response, the Federal Reserve raised interest rates 11 times between March 2022 and July 2023, with the July increase marking the final rate hike in this cycle.

While it might seem like an abstract economic decision, the Fed’s interest rate cuts have real-world implications that affect your daily life. So what could it mean for you?

But first – the Fed’s interest rate, explained:

The federal funds rate, or the lending rate, is set by the Fed. This is the key interest rate that commercial banks use when borrowing and lending excess reserves to one another. As banks benefit from lower borrowing costs, they tend to pass these savings on to their customers – which will result in reduced loan rates for both consumers and businesses globally.

So, how is this relevant to me?

According to many experts, consumers should not anticipate significant immediate changes. Although the Federal Reserve is cutting its own lending rate, other financial institutions tend to be slow in reducing the rates they charge borrowers.

In theory, as the Fed’s key borrowing rate is a benchmark for other loans, when it fluctuates, it will have a broader impact on different consumer loan products around the globe. Moreover, other consumer-lending products might even rise or fall on the mere expectation that the Fed’s rates will change.

When interest rates are cut, borrowers are the first to enjoy the benefits. According to Collin Martin, fixed income strategist at the Schwab Center for Financial Research, “For borrowers, rate cuts are generally good news, because it lowers the cost of borrowing, but different parts of the market are impacted differently.”

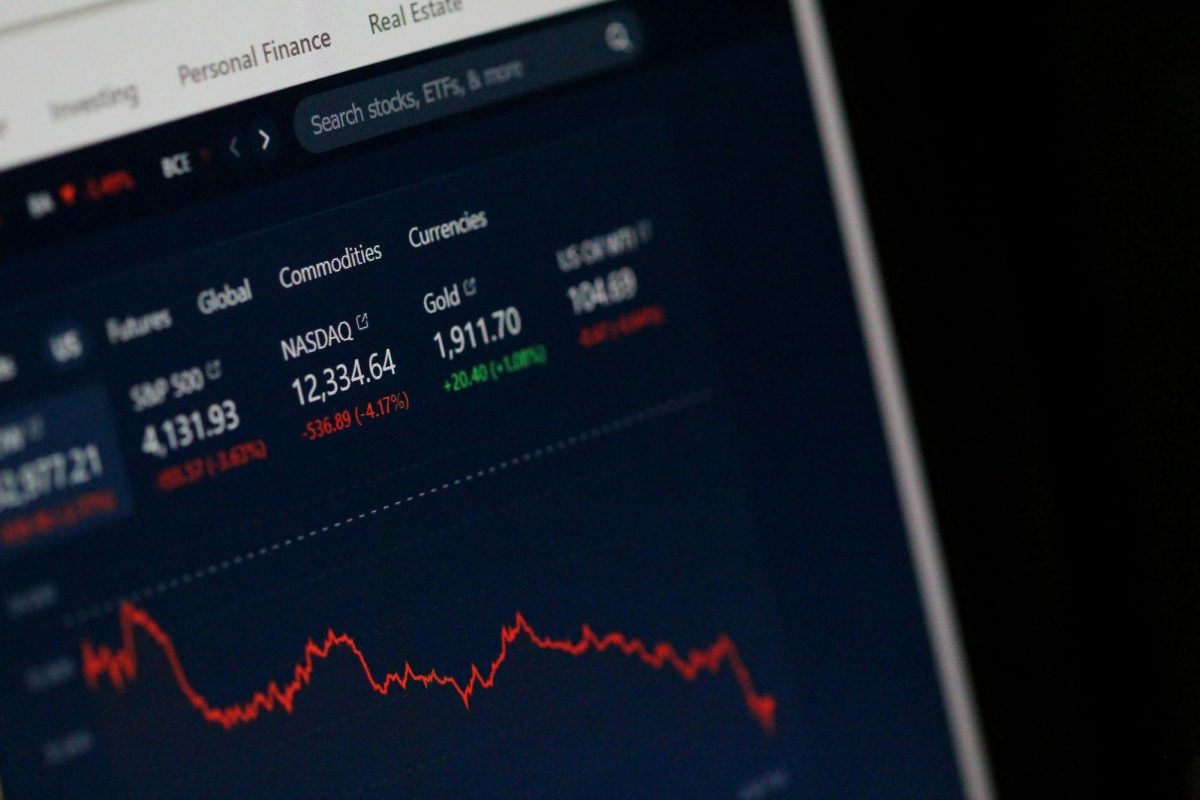

Typically, contrary to the current case, when interest rates increase, market participants frequently worry that the Fed might become overly assertive, which potentially slows economic growth excessively and even risks a recession. Such concerns significantly affected stocks in 2022, which resulted in the S&P 500’s weakest annual performance since 2008. This works vice versa for when interest rates are cut: cheaper borrowing rates encourage investors to take more risk in their portfolios, especially for those attempting to make up for underperforming returns. Those who have been apprehensive about an economic downturn may also view interest rate reductions as a source of relief.